Coinbase Shares Declined 50% From All-Time High, Stock Follows Bitcoin’s Ups and Downs – Finance Bitcoin News

[ad_1]

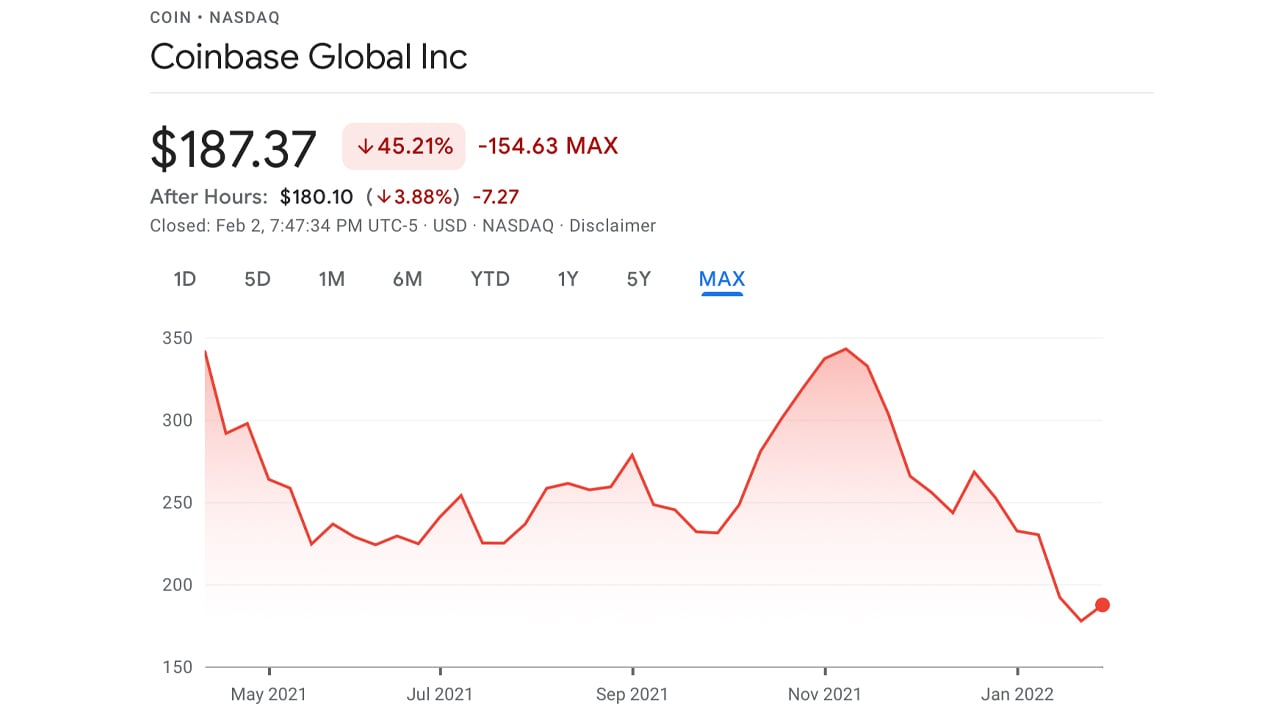

Roughly 9 months in the past, Coinbase’s preliminary public providing (IPO) through a direct itemizing on Nasdaq launched, and shares swapped for $342 per share on April 16, 2021. Since then, Coinbase shares have dropped by near half that worth and at the moment, COIN is swapping for greater than 45% decrease at $187 per unit.

Coinbase Follows Bitcoin With Shares Down 45% From ATH

Coinbase (Nasdaq: COIN) is a well-liked crypto agency and digital asset change with 8.8 million month-to-month transacting customers throughout its peak in Q2 2021. The enterprise based by Fred Ehrsam and Brian Armstrong in 2012 formally went public on Nasdaq on April 14, 2021, through a direct itemizing. As the corporate heads into its tenth operational 12 months, COIN shares have been buying and selling for a lot lower than the inventory’s worth on April 16 and November 12, 2021.

When COIN first launched, the inventory change Nasdaq selected an preliminary $250 per share reference value. Two days later — and whereas bitcoin (BTC) reached $64K per unit — COIN tapped a excessive of $342 per share. The Coinbase inventory dropped in worth after that day, and dipped to a consolidated low of $242 throughout the months of May by September, with just a few jumps to the $250-278 vary throughout that point.

The Nasdaq-traded inventory follows alongside BTC’s fluctuations like many crypto-asset companies which have publicity to this new asset class. So when BTC ran as much as one other value excessive past $64K to an all-time excessive of $69K, COIN hit one other $342 value excessive. The inventory is now near half the $342 value excessive, and is 45.16% decrease in worth, buying and selling at $187 per share. Similar to BTC, the value is far decrease than the ATH and in December COIN had a short Holiday rally alongside the crypto economic system’s passing comeback that month.

‘Fed’s Stance on Interest Rates Could Hurt the Stock’s Momentum,’ Says Boston Data Analyst Firm Trefis

In a current weblog publish, the Boston-based information and analytics agency Trefis requested if the Coinbase inventory was a great purchase after such a sizeable correction. “The stock currently trades at just about 22x our projected 2021 earnings, which is not a particularly rich valuation for a highly profitable and futuristic stock with solid long-term earnings potential,” Trefis mentioned on Wednesday. “For perspective, Coinbase’s net margins stood at an incredible 57% over the first three quarters of 2021.”

The information and analytics agency added:

However, the cryptocurrency market is inherently cyclical, and the percentages are that we could possibly be approaching a market peak given the Fed’s stance on rates of interest. This might damage momentum for Coinbase within the close to time period. That mentioned, the inventory might nonetheless be value a search for long-term traders.

What do you consider the present worth of Coinbase’s inventory and the sizeable correction shares have seen since its ATH? Let us know what you consider this topic within the feedback part under.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational functions solely. It will not be a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss precipitated or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link